Protecting Vehicles from a Hurricane

Protecting Vehicles from a Hurricane

Property Loss Checklist

Here is a Property Loss Checklist

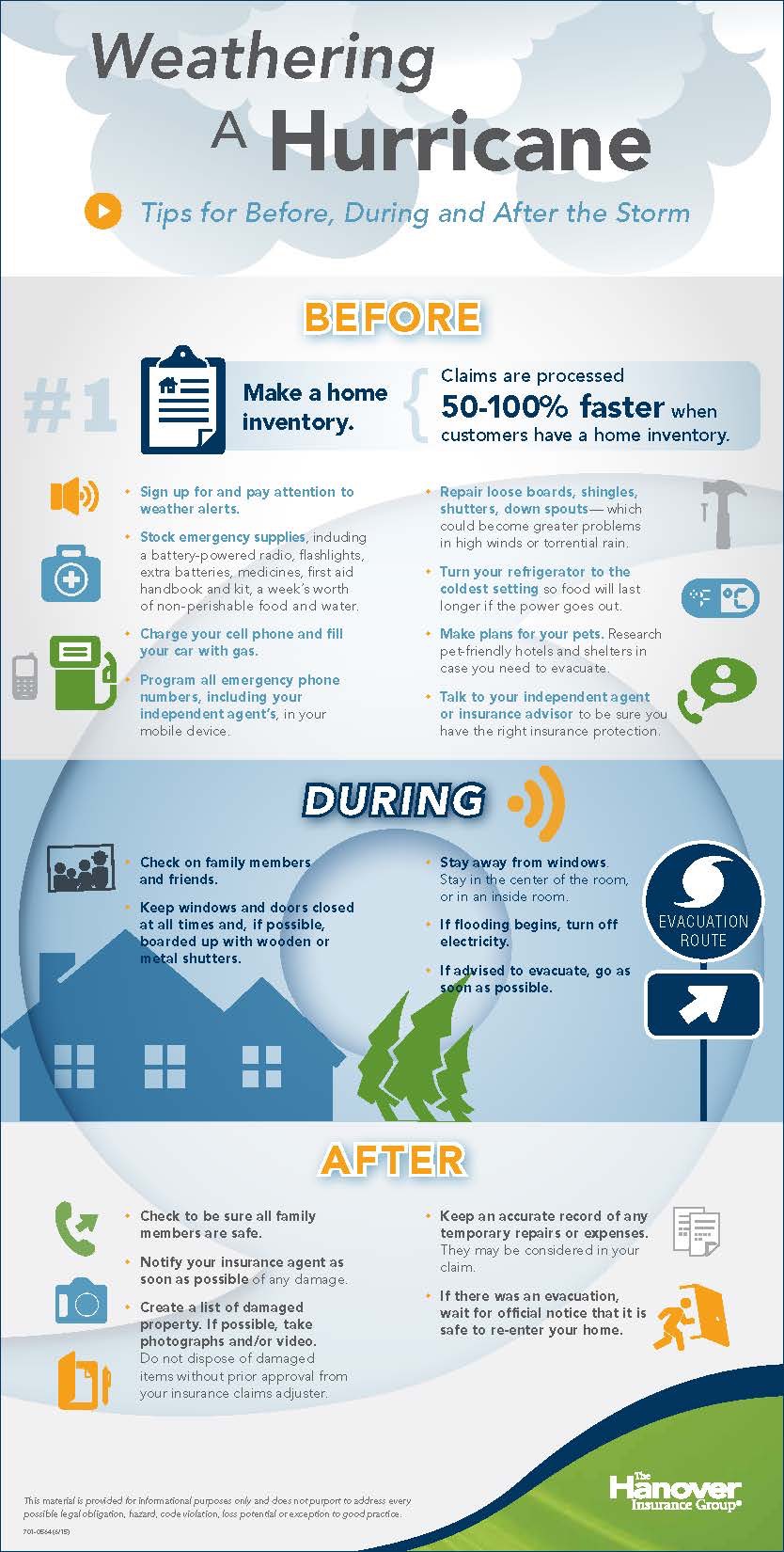

Peak Hurricane Season is Upon Us. Here are Tips to Help You Stay Safe

Peak Hurricane Season is Upon Us. Here are Tips to Help You Stay Safe.

Waiver of Subrogation-Landlord and Tenant Lease Relationships

Waiver of Subrogation-Landlord and Tenant Lease Relationships

A waiver of subrogation is used in a commercial lease for the protection of one or both, the landlord and the tenant, to avoid duplicate payments made through the other party’s insurance policy, for the same negligible loss.

The Landlord maintains property insurance on the building. The Tenant maintains property insurance on the tenant’s business personal property. If the tenant pays a portion of the building premium to the landlord, and the tenant causes negligence to the building, the landlord’s insurance carrier can file suit against the tenant for building damages without the appropriate waiver of subrogation in place. The landlord has already collected premium from the tenant, as well as received payment from the landlord’s insurance policy, and can now recover the damages through subrogation of the tenant’s policy.

A waiver of subrogation will prevent the landlord’s insurance company from filing a claim and collecting against the tenant. The landlord and tenant should negotiate the terms of the waiver, and as to whether the waiver will be mutual, or only to benefit one party, and the extent of the coverage under the waivers.

Waivers can be negotiated against the two parties and must be a requested clause on the property insurance policy. Limits can be negotiated and stated on the waivers to the extent of the amount of insurance required to be carried on that property under the lease. Mutual waivers of subrogation can benefit and protect both the landlord and the tenant. Confirm with the insurance carriers if the waivers are allowed by each of the respective insurers and to be sure they are in compliance with the landlord and tenant lease.

Insurance requirements in your lease should be reviewed by your agent to be sure the coverage is in compliance and can be indicated on the certificate of insurance provided to both parties.

Roseanne Gedman, CPCU, CRM, CIC

Schechner Lifson Corporation

Renting a Car

Renting a Car

Business entity automobile liability exposures – what is hired and non-owned auto liability?

Hired automobile coverage – when an owner or an employee drives a rented, hired, or borrowed vehicle.

Non-owned auto coverage – when an employee drives their own personal vehicle on company time for company business.

If the business entity does not own vehicles in the entity name, the hired and non-owned auto liability coverage can be added to the business entity’s business package or general liability policy.

As a businessowner, you can become legally liable for the actions of your employees. If you are held accountable, it is important to understand your exposures to loss and to be sure you are adequately protected.

Employees who operate their own vehicle present potential loss exposures to you while they are driving their own vehicles. Exposures to loss you may not think of such as employees running bank errands, post office drop off, picking up a client, picking up office supplies and any other errands the employee is instructed to perform while on company time, using their own vehicle.

Although the employee would maintain their own personal automobile insurance, it is hard to force the employee to maintain adequate limits that are affordable to them. It is likely that the loss to another as a result of an employee-related automobile accident would exceed the employee’s personal auto liability limits. The claimant and their attorney will be smart enough to bring suit against the employer organization for the limits in excess of the limits they have exhausted under the employee’s personal auto policy.

The hired and non-owned auto liability endorsement will help to defend and protect the entity when the suit arises out of bodily injury or property damage caused by an employee while using their vehicle for company business. The hired auto liability will replace the liability coverage offered at the rental car company when an employee is renting a vehicle on company time.

The cost associated with this coverage is minimal and should be added to all business auto or general liability policies to protect and defend the entity for employee related personal auto lawsuits while the employee is using their vehicle for company business, or renting a vehicle on company time.

Roseanne Gedman, CPCU, CRM, CIC

Schechner Lifson Corporation

Cyber/Crime/Social Engineering Fraud… We are all at risk, but what does it all mean?

Cyber/Crime/Social Engineering Fraud. . . We are all at risk, but what does it all mean?

While Cyber and Crime coverage are separate, they can be written together with one carrier. These carriers also provide risk management services, web-based training for executives, managers and human resource personnel, model employee handbooks, and weekly articles on current issues.

To help simplify the key areas of concern, outlined below are very basic definitions to help understand the exposures that can adversely impact the assets of your organization. These exposures highlighted below are not addressing employee related acts of dishonesty.

Cyber liability

Network and Information security wrongful act: The failure to prevent unauthorized access to or use of electronic or non-electronic data containing identity information. Failure to provide notification of any potential unauthorized access to or use of data containing private or confidential information of others if such notification is required by any Security Breach Notification law. Failure to prevent the transmission of a computer virus to a computer network not owned, leased or under the control of your organization.

Cyber and privacy policies cover a business’ liability for a data breach in which the firm’s customers’ personal information, such as Social Security or credit card numbers, health and medical information, is exposed or stolen by a hacker or other criminal who has gained access to the firm’s electronic network. The policies cover a variety of expenses associated with data breaches, including: notification costs, credit monitoring, costs to defend claims by state regulators, fines and penalties, and loss resulting from identity theft.

Costs to consider: Cost to determine scope of the breach, costs paid as compensation to the individual(s) or entity as a result of the breach, fees, and expenses to comply with law or any regulation, taxes, fines, penalties, expense to replace, upgrade or maintain a computer system.

Crime

Computer fraud means an intentional and unauthorized/fraudulent entry of data or computer instructions by someone other than an employee or individual under the direct supervision of the insured, and changes made via the internet that cause money or other property to be transferred, paid or delivered. An unauthorized or fictitious amount to be debited or credited. Direct loss of money, securities or other property caused by computer fraud.

Funds Transfer

An intentional, unauthorized and fraudulent instruction transmitted by electronic means, voice, electronic mail, electronic text, to a financial institution directing such institution to debit an account and to transfer, pay or deliver money from such account and was submitted by someone other than an employee without the insured’s knowledge or consent.

EMPLOYEE: Any Natural person whose labor or service is engaged by and directed by the insured organization, including full-time, part-time, seasonal or temporary workers, volunteers, students, interns or leased employees to the insured organization.

Social Engineering Fraud/Funds Transfer

When an employee is intentionally misled into sending money or diverting a payment based on fraudulent information that is provided to them in a written or verbal communication such as an email, fax, letter or even a phone call.

How does this happen? This surprisingly successful fraud happens every day to unsuspecting employees when receive a message that appears to be from a legitimate vendor, client or supplier that contains a variety of requests and information. In many cases, the fraudster has infiltrated an email conversation and has been able to obtain the client, vendor or suppliers signature section to make it appear even more legitimate. Some even amend phone numbers in the email panel, so a call back to a phone number would be directed to the fraudster, who would of course verify the information.

Examples of Chubb claims are attached. Chubb and Travelers are both quoting this coverage as an additional endorsement under the crime policy. Please complete the application so we may test the market and provide you with a quote.

Let’s discuss the coverage in more detail once we receive your completed applications and quotes from the carriers.

Download Applications

Click here for Cyber Liability application

Click here for Social Engineering application and samples

Roseanne Gedman, CPCU, CRM, CIC

Schechner Lifson Corporation

Would You Know If You Had A Broken Pipe?

Would You Know If You Had A Broken Pipe?

When the temperatures drop below freezing, water inside pipes can freeze and expand. If water expands too much, it can crack the pipe, and also cause an ice blockage which in turns causes water pressure to increase further down the pipe. The damage often goes unnoticed until the weather warms up and the water thaws–causing pipes to burst.

The pipes most at risk are those that are not protected along their entire length by the building insulation or insulation on the actual pipe itself.

Here are some warning signs that you may be dealing with a broken pipe:

Sounds That Can Indicate Broken Pipes

Bubbling Noises: When you flush the toilet or use the sink, air that cannot escape to the sewer lines will create a bubbling noise. This can be a sign that there is a pipe broken, and it should be inspected.

- Whistling Noises: If a pipe gets dented, it can create a segment of pipe that is too small for the volume of water that needs to travel through it and when it does it can emit a whistling sound. If a whistling sound suddenly occurs, it should be checked out, as soon as possible. Increased water pressure on compromised pipes can cause the pipe to burst.

- Banging or Clanking: If loose pipes bump into one another, a clanking noise will be the result. Whether due to loose washers or other worn parts, loose pipes can cause tension that can lead to holes or leaks.

If you hear any of these noises, have your pipes inspected.

Sights & Smells That Can Indicate Broken Pipes

- Unpleasant Odor: If drains, sinks, or any area of your property has an unpleasant odor, especially on the lowest floor, it can be a sign that a pipe is backed up or broken. The odor is a sign that sewage is not being successfully transported from your pipes to the municipal sewer lines.

- Sink Holes: If you have sink holes, or any unexplained soggy or wet areas in your lawn, there may be a break in the main pipes underground.

- Puddles: If water is accumulating anywhere in your property, especially under sinks or on floors, a pipe may be broken. Some may be easy to detect and see, such as pipes under the sink or the water supply to the toilet, but others may be behind walls or ceilings.

- Damp Drywall: If the drywall is damp anywhere in your property, or if there are wet rings on the ceiling, this is a sure indicator of a broken or burst pipe.

If you see or smell anything it is best to have it checked out as quickly as possible.

Other Signs of a Broken Pipe

- Persistent Clogs: Whether it is a clogged drain or a slow-flushing toilet, any problem that is persistent is an indicator that something is wrong. Broken pipes and blockage are not the only reasons these conditions will exist, but they should not be ruled out.

- Frequent Backups: If basement drains, laundry tubs, or other drains have frequent backups or there are water stains around any of the drains and you have not used them, this can be an indicator that the sewage lines are broken or blocked.

- No Water: If you turn on the faucet, laundry machine, or dishwasher and no water comes out or the pressure is very low, pipes may be frozen, or there may be a broken pipe underground. There are many new technologies to repair underground pipes that have broken without digging them up.

- Poor Water Quality: If the water suddenly turns color or begins to smell, this can be an indicator that the pipes have begun to corrode or otherwise become contaminated or deteriorated.

- High Water Bill: If your water bill is significantly higher than usual without any unusual activity, it may be an indicator of a broken pipe. Physical indicators such as puddles, odors, or damp drywall will usually show themselves first, but in cases when breaks remain undetected, escalated bills can help detect problems.

What To Do If Your Pipes Freeze

- Keep the faucet open. As you treat the frozen pipe and the frozen area begins to melt, water will begin to flow through the frozen area. Running water through the pipe will help melt ice in the pipe.

- Apply heat to the section of pipe using an electric heating pad wrapped around the pipe, an electric hair dryer, a portable space heater (kept away from flammable materials), or by wrapping pipes with towels soaked in hot water. Do not use a blowtorch, kerosene or propane heater, charcoal stove, or other open flame device.

- Apply heat until full water pressure is restored. If you are unable to locate the frozen area, if the frozen area is not accessible, or if you can not thaw the pipe, call a licensed plumber.

- Check all other faucets in your property to find out if you have additional frozen pipes. If one pipe freezes, others may freeze, too.

Addressing problems with the water supply or drainage quickly is important to help prevent mold growth. Preventing problems from occurring or preventing them from getting worse will help keep your property safe and healthy for everyone.

If you need emergency help with property damage call 800.3MAXONS (800.362.9667)

Stay safe

Winter Weather Preparation

Winter Weather Preparation

We know that your business’s safety this winter is dependent on being prepared for whatever winter might bring. Below are a few of the steps you can take today to address the most common problems that cause property damage in winter.

What do you need to do?

Cold air in enclosed spaces

- Visually inspect concealed spaces for gaps in wall materials; water pipes in these areas can freeze if unprotected

- Keep these spaces warmed to at least 50° F or use certified heat tape

Sprinkler systems and related equipment

- Keep building temperatures at 50° F for wet-pipe systems, including the enclosures housing a riser equipped with a dry pipe valve

- Dry pipe systems should be drained at the low point prior to the onset of cold weather

- Service and inspect all hydrants, tanks, fire dept. connections and sprinkler systems accessories before the onset of cold weather

General building protection

- Inspect vacant buildings or unoccupied areas of the building during cold weather to be sure heating systems are functioning properly

- Identify sources of cold air infiltration and repair leaks or seals

- Inspect roofs to be sure they can withstand snow loads; remove snow from roofs if roof strength is in question

- Keep gutters, downspouts and roof drains clear to avoid clogging and freezing

Preventing ice dams

- Increase insulation above ceilings inside the building

- Consider the use of heating cables to prevent ice dams

- Increase ventilation in attic spaces

- Inspect roofs for evidence of standing water (mold, mildew, vegetation) that might indicate future problems, and address the situation with a roofing contractor

- SAFELY remove snow with a roof rake or stiff-bristled broom when ice dams have been a problem (always follow OSHA guidelines for worker safety during roof work)

Responding to a heat loss event

- Drain any equipment that contains water that could freeze if the temperature drops

- Investigate sources of temporary heat to be prepared for low temperatures

- Train security or maintenance/facility personnel in how to close automatic sprinkler valves if a leak or break should occur.

Where can you find more resources?

View the full lists of precautions you can take to help reduce the likelihood of winter weather damage. Or visit Risk Solutions’ Severe Weather page for more details.

- « Previous Page

- 1

- …

- 9

- 10

- 11

- 12

- 13

- …

- 17

- Next Page »